A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. We will take you through the notable changes made to the above tax law including the issuance of Public Ruling PR No.

Inland Revenue Board Of Malaysia Qualifying Expenditure And Computation Of Capital Allowances Public Ruling No 6 Pdf Free Download

It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied.

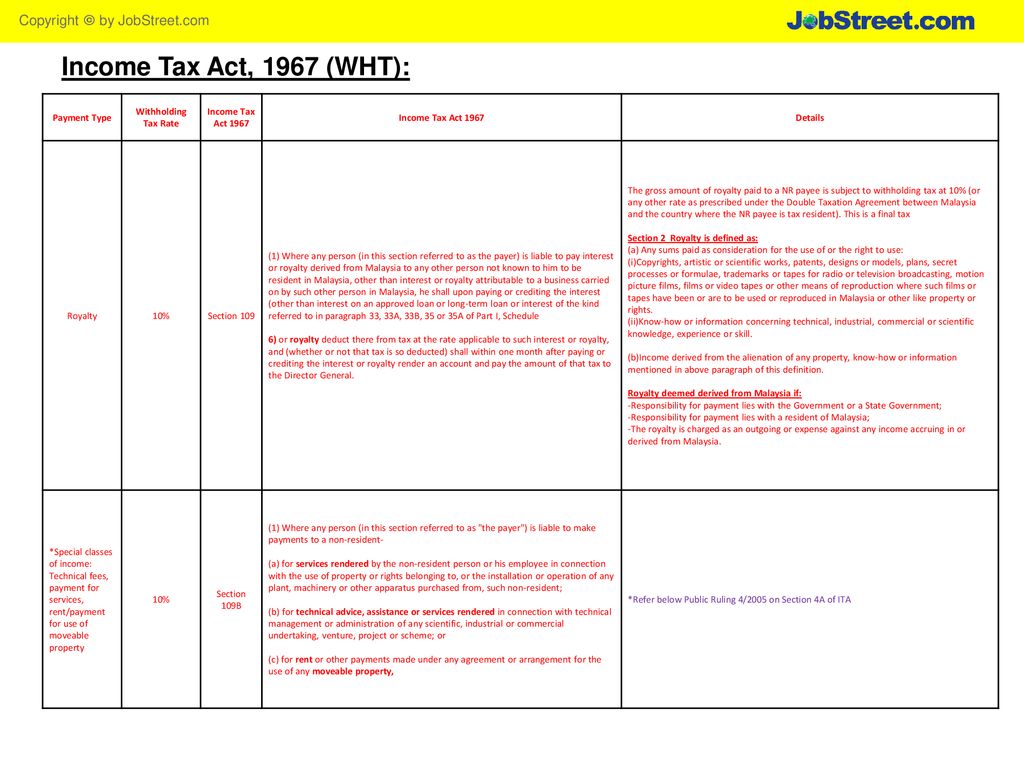

. Tax Espresso Special Alert Public Ruling PR No. WITHHOLDING TAX ON SPECIAL CLASSESS OF INCOME Public Ruling No. 112018 which explains the special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA and related withholding rules.

12014 of 23 January 2014. PR 112018 reflects changes to the tax law made via the Finance Act 2017 and other guidance. 19 April 2010 CONTENTS Page 1.

112018 including an update of latest tax cases on withholding taxes together with the revised Guidelines on. Non-resident company based in Malaysia to provide training to ABC Sdn Bhd staff on its customer service relationship. The Income Tax Act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non-resident public entertainers to a non-resident person NR payee he shall deduct withholding tax at the prescribed rate from such payment and whether such tax has been deducted or not pay that tax to the Director General.

Malaysia is subject to withholding tax under section 109B of the ITA 1967. 102019 that replaces PR No. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA.

12014 Withholding Tax on Special Classes of Income. Withholding tax is a form of income tax. Derivation of gains or profits under paragraph 4 f 2 - 3 5.

102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. And paid to the inland revenue authority of singapore iras. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

We will also look at the Guidelines in determining whether a PoB exists in Malaysia as well as the Guide on Digital Services by Foreign Service. The Ruling updates and replaces PR No. This new 27-page PR replaces PR No.

MALAYSIA WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME Public Ruling No. 10 Objective 20 Relevant provisions of the law. Income falling under paragraph 4 f chargeable to tax 1 - 2 4.

The main points of the public ruling are as follows. 42020 of 16 June 2020 on the tax treatment of any sum received and a debt owing that arises in respect of services to be rendered which changed with effect from the Year of Assessment 2016. 1 APRIL 2017 REVENUE DIVISION MINISTRY OF FINANCE.

Ii withholding tax in the DTA between Malaysia and Singapore. On 26 November 2019 the Inland Revenue Board of Malaysia published Public Ruling No. 32013 which was published on 15 March 2013 see Tax Alert No.

The IRB has published PR No. 12014 last amended on 27 June 2018. Objective The objective of this Public Ruling PR is to explain - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA.

Payments made to non-residents in respect of the provision of any advice assistance or services performed in Malaysia and rental of movable properties are subject to a 10 WHT unless exempted under statutory provisions for purpose of granting incentives. Example 1 Syarikat Maju Sdn Bhd a Malaysian company signed an agreement with Excel Ltd a non-resident company to provide a report addressing the. The Inland Revenue Board of Malaysia IRBM announced that the remittance of 2 withholding tax under the new Section 107D of the Income Tax Act 1967 ITA inserted via the Finance Act 2021 which has come into operation on 1 January 2022 is deferred until 31 March 2022.

It sets out the interpretation of the Director General of Inland Revenue in. It sets out the interpretation of the Director General in. During the tabling of the National Budget 2022 the Government of Malaysia.

Training services are subjected to witholding of tax at the. 62017 Date Of Publication. INLAND REVENUE BOARD OF MALAYSIA WITHHOLDING TAX ON INCOME OF A NON-RESIDENT PUBLIC ENTERTAINER Public Ruling No.

Sources shown in the preceding table. 12 September 2005 ii DIRECTOR GENERALS PUBLIC RULING A Public Ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board. A Public Ruling may be withdrawn either wholly or in part by notice of withdrawal or.

Tax on Special Classes of Income Public Ruling No. Ltd a foreign company earns interest income from its subsidiary. The Public Ruling includes that under subsection 331 of the Income Tax Act 1967 ITA an outgoing or an expense which is wholly and exclusively incurred in the production of.

112018 on 5 December 2018 which supersedes the previous guidance on nonresident withholding tax on special classes of income PR No. Fx rate is based on rates published in the IRB or Bank Negara Malaysias. 62019 on the tax treatment of expenditure for repairs and renewals of assets.

102019 and an update of the latest tax cases on withholding taxes. A Ruling may be withdrawn either wholly or in part by. A Public Ruling may be withdrawn either wholly or in part by notice of withdrawal or by publication of a new ruling.

The Inland Revenue Board of Malaysia IRBM has issued Public Ruling PR No. 10 December 2019 Page 1 of 42 1. The new PR comprises the following paragraphs and sets out 21 examples.

INCOME TAX PUBLIC RULING WITHOLDING OF TAX ON SPECIFIED NATURE OF PAYMENTS PR NO. Individual income tax in malaysia for expatriates. 12010 Date of Issue.

The Inland Revenue Board IRB of Malaysia issued Public Ruling PR No. Tax provisions and support you in complying with your withholding tax obligations particularly by taking you through the notable changes made to the tax law with the issuance of Public Ruling PR No. Withholding tax Certain receipts may be subject to withholding tax such as.

Rendered in Malaysia by a public entertainer withholding tax under section 109A of the ITA 1967 final tax. 102019 Withholding Tax on Special Classes of Income Introduction The Inland Revenue Board of Malaysia IRBM has recently released PR. 112018 Withholding Tax on Special Classes of Income PR 112018 The Inland Revenue Board of Malaysia IRBM has uploaded on its website the PR 112018 issued on 5 December 2018 which supersedes the previous Public Ruling No.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. Example 7 is amended to state that a reimbursement such as local. The Inland Revenue Board of Malaysia IRBM has issued Public Ruling No.

Public Ruling No. BIK dated 12 December 2019. 2 from A public ruling is published as a guide for the public and officers of the inland revenue board of malaysia.

42005 Date of Issue. The IRB has issued Public Ruling 112018 - Withholding Tax on Special Classes of Income PR 112018 dated 5 December 2018 replacing the earlier Public Ruling 12014 - Withholding Tax on Special Classes of. Be used to calculate the WHT in Ringgit Malaysia.

WITHHOLDING TAX ON INCOME UNDER PARAGRAPH 4f INLAND REVENUE BOARD MALAYSIA Public Ruling No.

Financing And Leases Tax Treatment Acca Global

Enewsletter 06 2020 Rsm Malaysia

Inland Revenue Board Of Malaysia Malaysian Institute Of Accountants

Pr Po Process Flow By Jace Cheah Ppt Download

Allowable Pre Operational And Pre Commencement Of Business

Demystifying Malaysian Withholding Tax Kpmg Malaysia

Payments That Are Subject To Withholding Tax Wt

How Is Foreign Sourced Income Taxed Thannees Articles

Demystifying Malaysian Withholding Tax Re Run Kpmg Malaysia

Tax Treatment For Entertainment Expenses

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

Financing And Leases Tax Treatment Acca Global

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

Pr Po Process Flow By Jace Cheah Ppt Download

Tax Alert Grant Thornton Malaysia

Five Public Rulings Updated And One New Public Ruling Issued By The Inland Revenue Board Ey Malaysia